Technical background of

the

Ascent Volatility

Trading Program

The expected volatility of the

S&P500 stock market index is measured by the volatility

index VIX of the CBOE. It is calculated as the implied volatility of a

basket of call and put options on the S&P500 index.

In times of crisis, the volatility

index VIX tends to go up. Some stock market participants try to

use the VIX to hedge their portfolios.

It is not possible to invest

directly in the Volatility Index VIX, but futures on the VIX are

traded since 2004. Market participants can use these as stock portfolio

insurance.

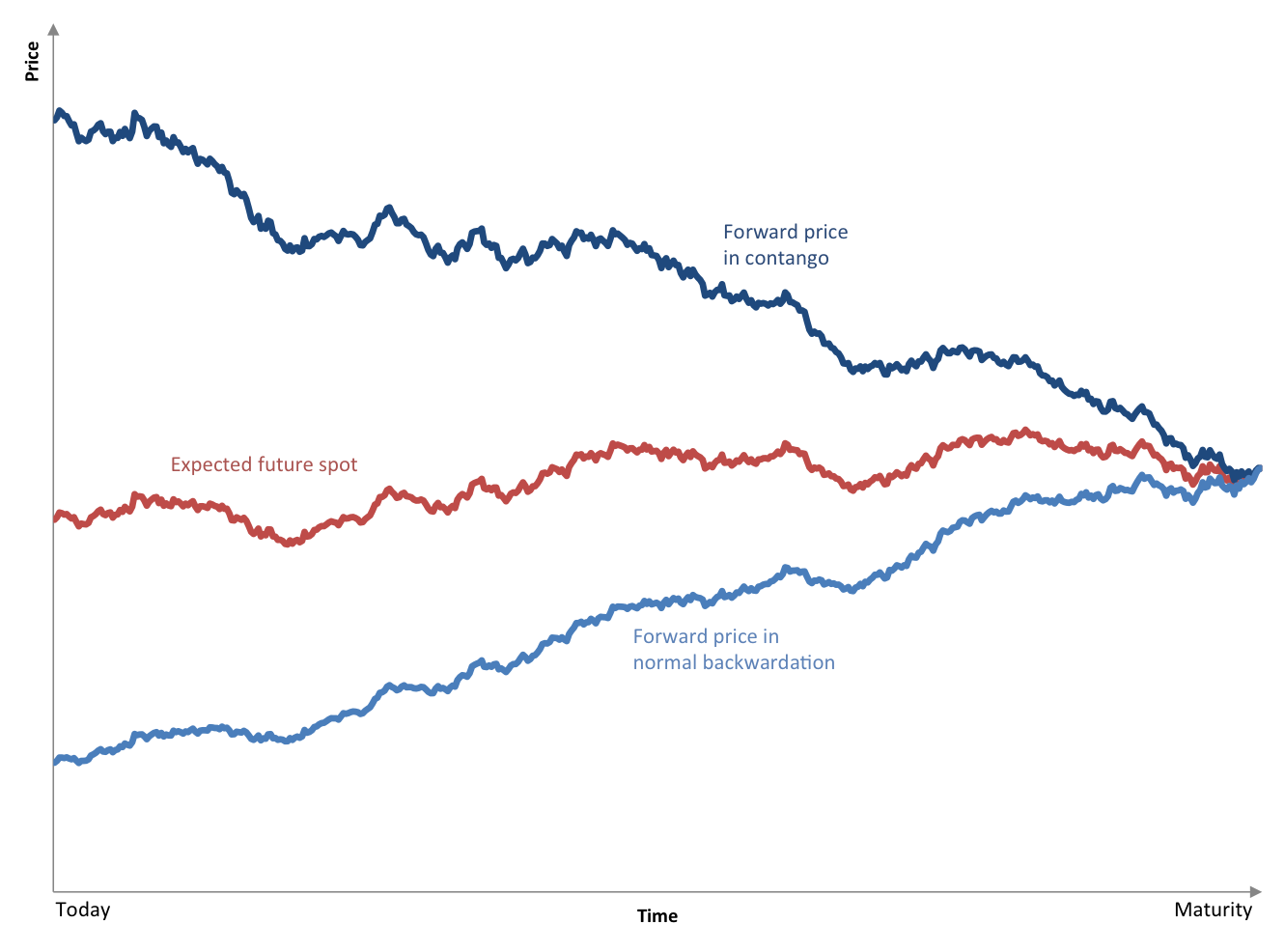

Futures introduce a new element in

the investment equation: the presence of either contango or

backwardation. Contango means that futures contracts further

away in time are more expensive than closer futures contracts.

Backwardation means the opposite, i.e. futures contracts further

away in time are cheaper than closer futures contracts.

From Wikipedia

:

The

graph depicts how the price of a single forward contract will behave

through time in relation to the expected future price at any point

time. A contract in contango will DEcrease in value until it equals the

spot price of the underlying at maturity. A contract in backwardation

will INcrease in value until it equals the spot price of the underlying

at maturity.

Most of the time, the VIX futures

market has been in contango, which means that e.g. futures

contracts 2 months out are more expensive than futures contracts

one month out. Market participants pay a premium for further out

volatility contracts, to protect themselves against unforeseen market

deterioration. The further away in the future, the more difficult it is

to predict market turmoil, and the higher the need for volatility

protection. This protection can be very expensive though.

Regularly, the price of the second month VIX future contract has

been 10% higher than the first month contract. If nothing spectacular

happens, and the VIX stays roughly constant during that month, the

buyer of the 2nd month VIX future loses 10%. The seller of the future

would have earned 10%. A long position (buying the future) must

overcome the contango price hurdle before it becomes profitable. A

short position (selling the future) has an easier time becoming

profitable in a contango situation.

The inverse holds in a backwardation

situation, where the second month volatility future is cheaper than the

first month future. This may happen after a large volatility spike,

where market participants expect the volatility to decrease further out

in time. As an example of a transaction in this situation:

suppose the second month future is 10% cheaper than the first month

future. If the market situation does not change, and the VIX

stays roughly constant during that month, the buyer of the second month

future VIX future would earn 10%. The seller of the future would have

lost 10%. A long position (buying the future) has an easier time

becoming profitable in a backwardation situation. A short position

(selling the future) must overcome the backwardation price hurdle

before it becomes profitable.

Since a couple of years, there

are Exchange Traded Notes (ETN) and Exchange Traded Funds (ETFs)

available on the stock market that invest in VIX futures, such as funds

VXX, XIV, VXZ, ZIV, VIXY, SVXY and UVXY.

In our volatility trading strategy,

we use proprietary indicators to determine when to go long or short

volatility.

Since 2004, the average price for "volatility

portfolio insurance" (contango between the first and second month

VIX future) is more than 5% per month, which translates to about

80% per year. Since the VIX is a mean-reverting index, an almost

constant expectation of growth is not realistic. Most of the time,

money can be made selling volatility insurance. Even if

we would sometimes mistime volatility spikes (for example during a

sudden crisis such as the 9/11 attack), and be short volatility at the

wrong time, a premium of 80% per year, provides a lot of buffer against

mishaps.

This is a speculative investment strategy, and only suitable for

investors who accept increased risk (including the possibility of

losing the entire investment), in exchange for possible increased

returns.

Comparison

against a simple volatility insurance selling strategy

Our positions are often equivalent to

selling volatility insurance, and one may wonder what the risk of such

a strategy is.

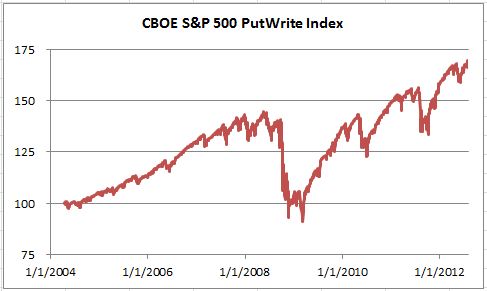

The CBOE S&P 500 PutWrite

Index represents a simple volatility insurance selling strategy. It

measures the performance of a hypothetical portfolio that sells S&P

500 Index (SPX) put options against collateralized cash reserves held

in a money market account.

Most of the time, the realized

volatility is lower than the volatility implied by the put option

prices, and a nice risk premium can be harvested. From time

to time, there are large stock market corrections, and the "insurance"

needs to be paid out, lowering the return of the strategy. Even after

the payouts, the strategy is still profitable, as the graph below shows.

In contrast, the Ascent Volatility

Trading Program relies on a different volatility insurance vehicle: it

uses VIX

futures, which represent a prediction of the price of S&P 500

options. The options by itself already contain a risk premium;

predictions of option prices contain an even higher risk premium that

can be harvested. The results of this approach are much better.

Note: past performance is not

necessarily indicative of future results. The value of your investment

can go up or down.

(1) Please note that

in extreme market circumstances, prices may drop beyond the stop

loss before a sell order gets executed. Large sudden price drops

are still possible.

|